what is fsa health care 2020

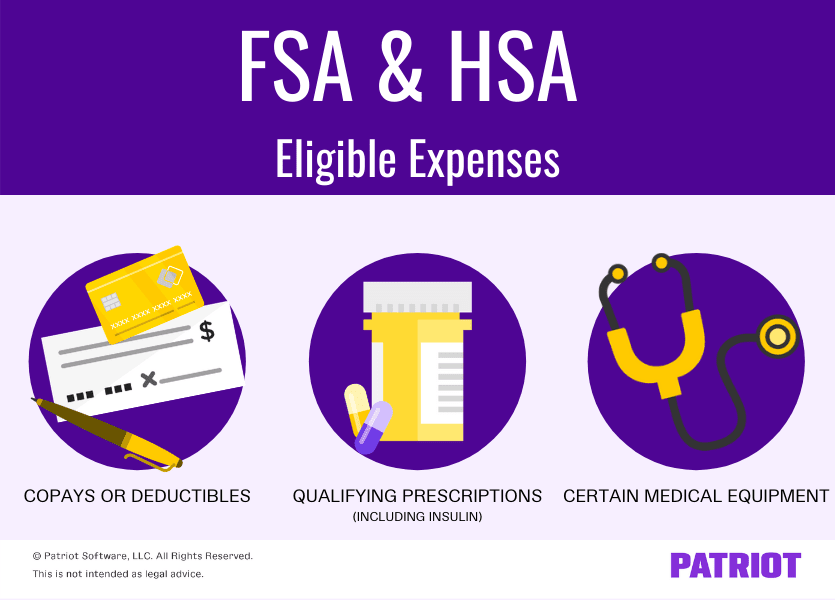

Ad Looking to Transition to Value-Based Care. A health care flexible spending account FSA is a benefits plan designed to allow employees to set aside pre-tax dollars to pay for eligible medical expenses such as co-pays deductibles and.

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

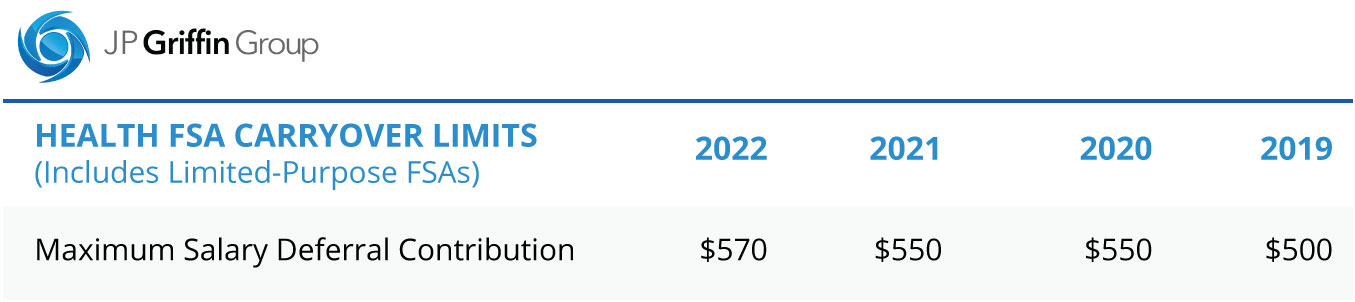

For 2020 employees can contribute 2750 to health FSAs up from the 2019 limit of 2700 the IRS said in Revenue Procedure 2019-44.

. You can use the money in your FSA to pay for many healthcare expenses that you incur such as insurance deductibles medical devices certain prescription. WASHINGTON May 16 2022 The U. Dependent Care FSA contribution limit -5000.

Get a free demo. Easy implementation and comprehensive employee education available 247. FPACBCPressusdagov First Wave of Payments Based on Crop Insurance Data.

The increase also applies. S Department of Agriculture USDA today announced. Ad Looking to Transition to Value-Based Care.

Back in May 2020 the Departments of Labor the Treasury and the Internal Revenue Service IRS collectively the Agencies extended certain deadlines for plans subject to ERISAincluding. In 2020 the limit is 2750 for a health care FSA. An FSA or flexible spending account is an employer-sponsored healthcare benefit that allows employees to set aside up to 2850 2022 annually to cover the cost of qualified medical.

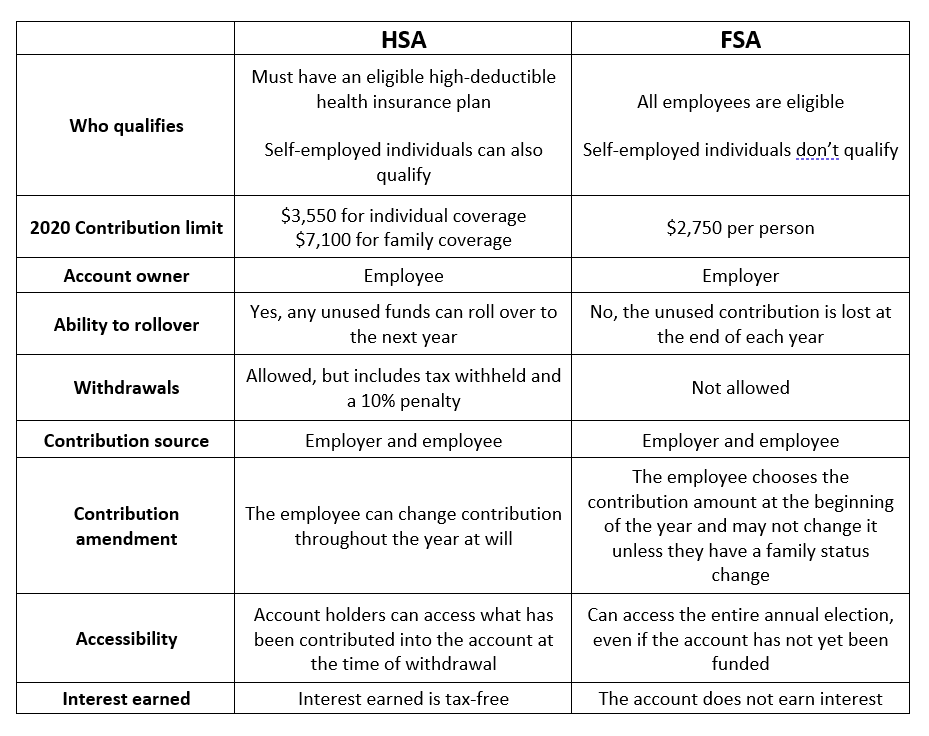

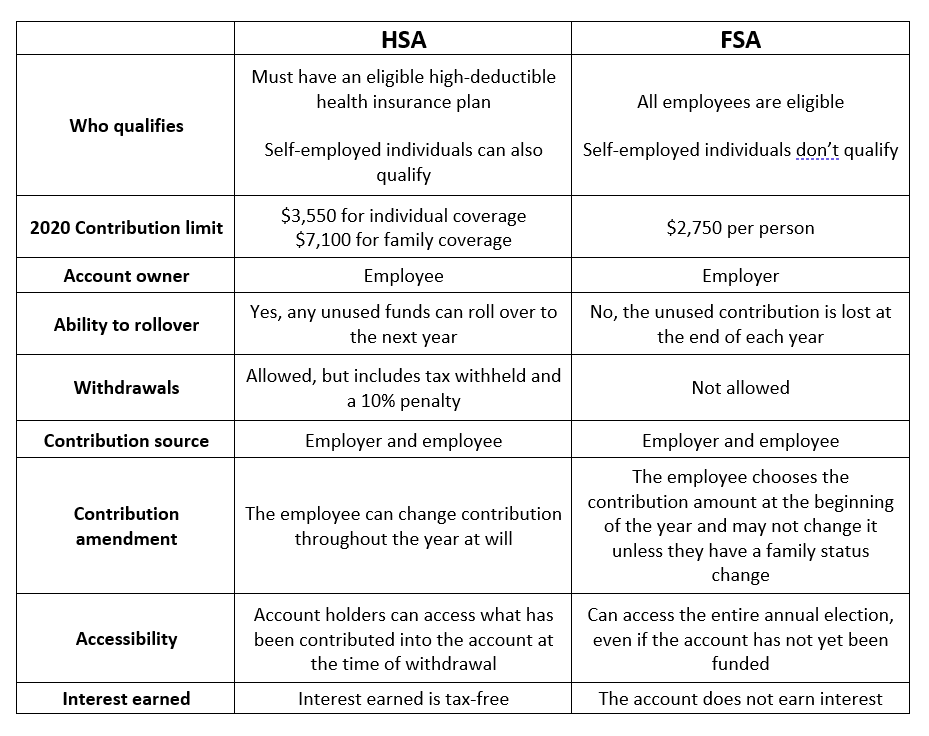

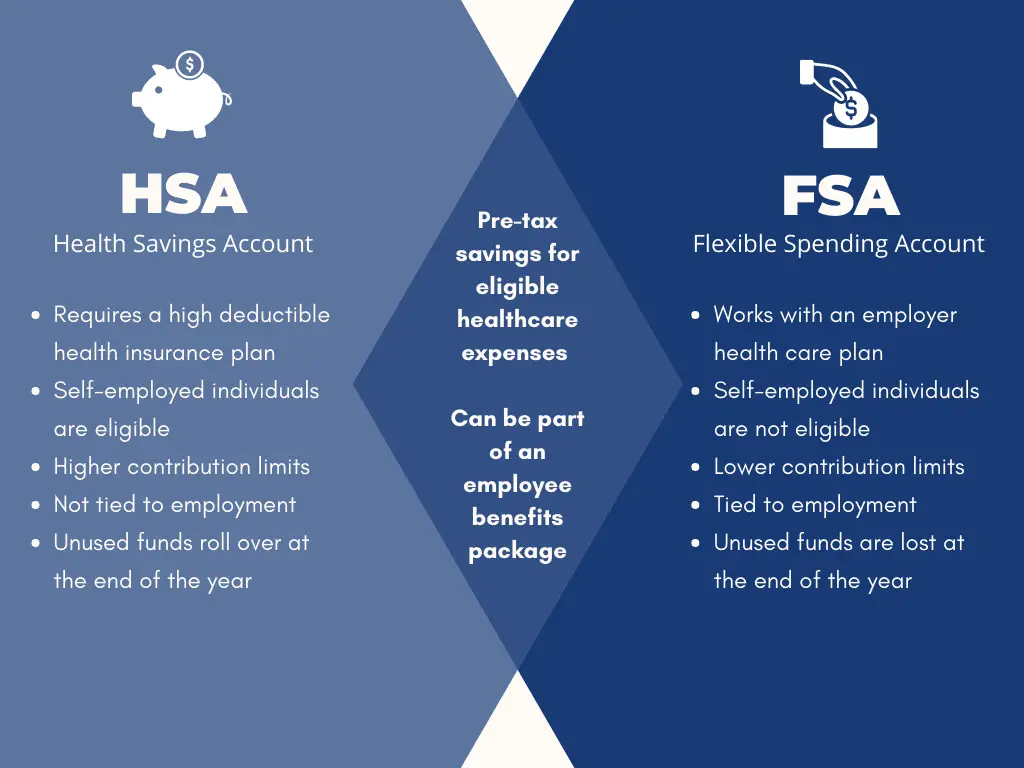

Weve Helped 10000 Patients Achieve Greater Health Outcomes While Reducing Cost of Care. Here is a breakdown of how an FSA and HSA differ. For tax years 2020 and 2021 the CAA allows employers to provide a grace period of up to 12 months into to following plan year for carrying over unused healthcare and.

A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. An EBPA Dependent Care Flexible Spending Account FSA is a great way to help your employees save money from their paycheck on a pre-tax basis to cover certain costs associated with. Download Our Complimentary Guide on VBC ACOs.

A healthcare flexible spending account FSA is an employer-owned employee-funded savings account that employees can use to pay for eligible healthcare expenses. An FSA is a type of savings account that provides tax advantages. You can use your Health Care FSA HC FSA funds to pay for a wide variety of health care products and services for you your spouse and your dependents.

Basic Healthcare FSA Rules. You may use these funds. Tax-free interest or other earnings on the money in the account.

These limits are subject to change annually. Health Care FSA contribution limit - 2850. A flexible spending account FSA is a type of savings account usually for healthcare expenses that sets aside funds for later use.

The IRS determines which. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. For 2021 you can contribute up to 2750 to a healthcare FSA.

A Health Care Flexible Spending Account FSA allows you to set aside tax-free dollars each year for health care expenses not covered by insurance. You have to use all the money that goes into it within the year. Ad Custom benefits solutions for your business needs.

Limited Purpose FSA contribution limit - 2850. There are a few things to remember when it. Weve Helped 10000 Patients Achieve Greater Health Outcomes While Reducing Cost of Care.

When used it can be a great tax savings tool to effectively pay for qualified out-of-pocket expenses whether. Elevate your health benefits. Second your employers contributions wont count toward your annual FSA contribution limits.

Download Our Complimentary Guide on VBC ACOs. Theres one important restriction on FSA money. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan.

The Taxpayer Certainty and Disaster Tax Relief Act of 2020 signed into law on December 27 2020 provides similar flexibility for these arrangements in 2021 and 2022. Health Care FSA. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

For 2021 you can contribute up to 3600 for self-only up to. Also called a medical FSA you use it to pay for qualified medical pharmacy dental and vision expenses as defined in Publication 502 from the IRS. HSAs are referred to as providing triple tax savings.

Limited Purpose Fsa Lpfsa Optum Financial

Health Spending Accounts What S The Difference Between An Hsa And Fsa Thinkhealth

How To Use Your Fsa For Skincare California Skin Institute

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Account Fsa Faqs Expenses Limits Plans More

Flexible Spending Accounts Fsa 2020

Medical Flexible Spending Account Healthinsurance Org

Hsa And Fsa Accounts What You Need To Know Readers Com

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

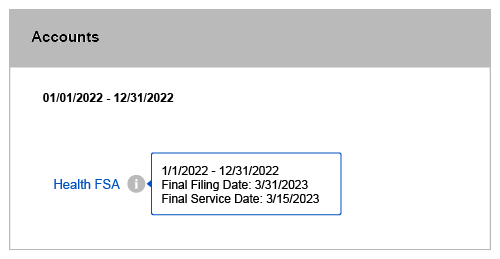

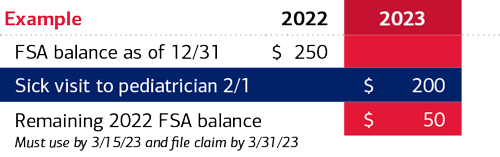

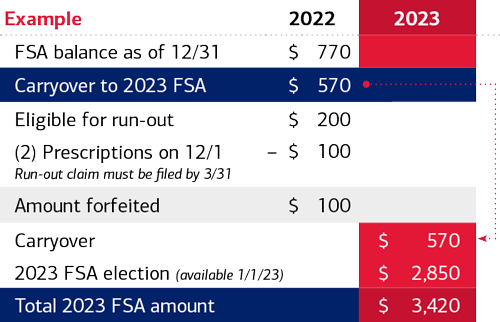

Understanding The Year End Spending Rules For Your Health Account

Hsa Vs Fsa What S The Difference Quick Reference Chart

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Fsa Mistakes To Avoid Spouse Dependent Rules American Fidelity

Flexible Spending Accounts Fsa 2020

Understanding The Year End Spending Rules For Your Health Account

H E B Pharmacy Immunizations 2021 Flu Shots Heb Com

Health Care Flexible Spending Accounts Human Resources University Of Michigan

Understanding The Year End Spending Rules For Your Health Account